Japanese Title (邦題): 「先のショックで得たもの」末尾に

What I got after the previous shock

Good morning to the World and Kanmon!

When I watched TV news, I noticed that they were speaking one word repeatedly. It seems that business people and people who enjoy stock investment say current emergency as “Corona Shock”.

In such news, someone talked that we should learn from measures taken in previous shock, Lehman shock. So I looked back what was I doing during previous shock, and remembered what I got after the previous shock. To be exact, what I was ordered to get.

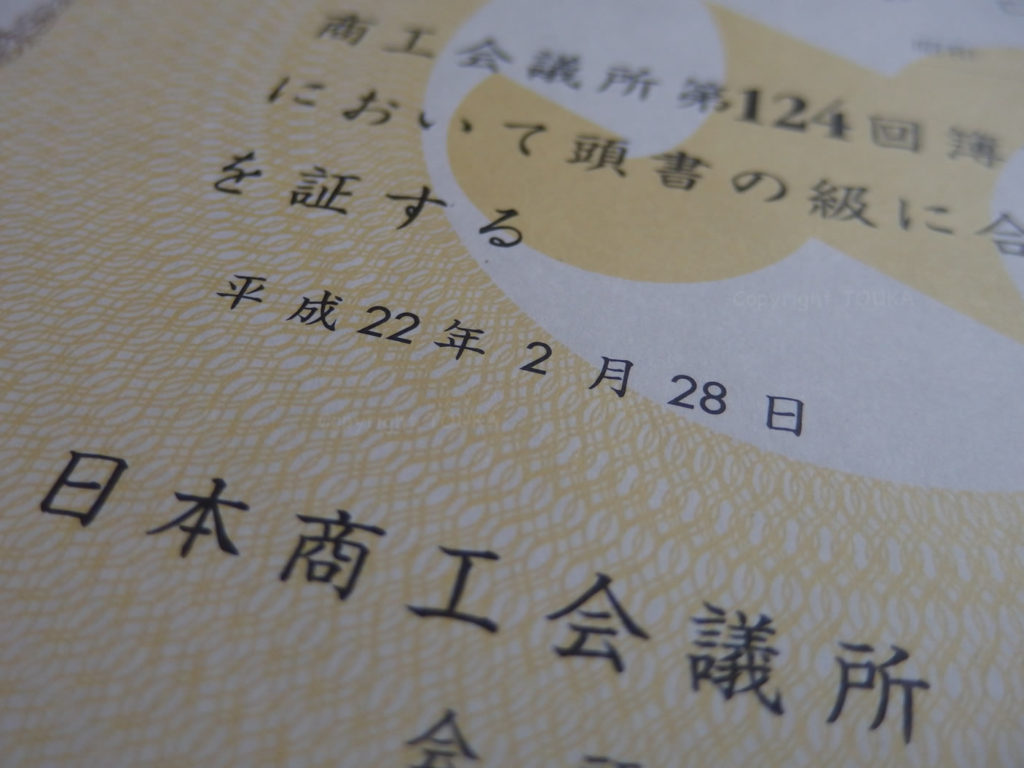

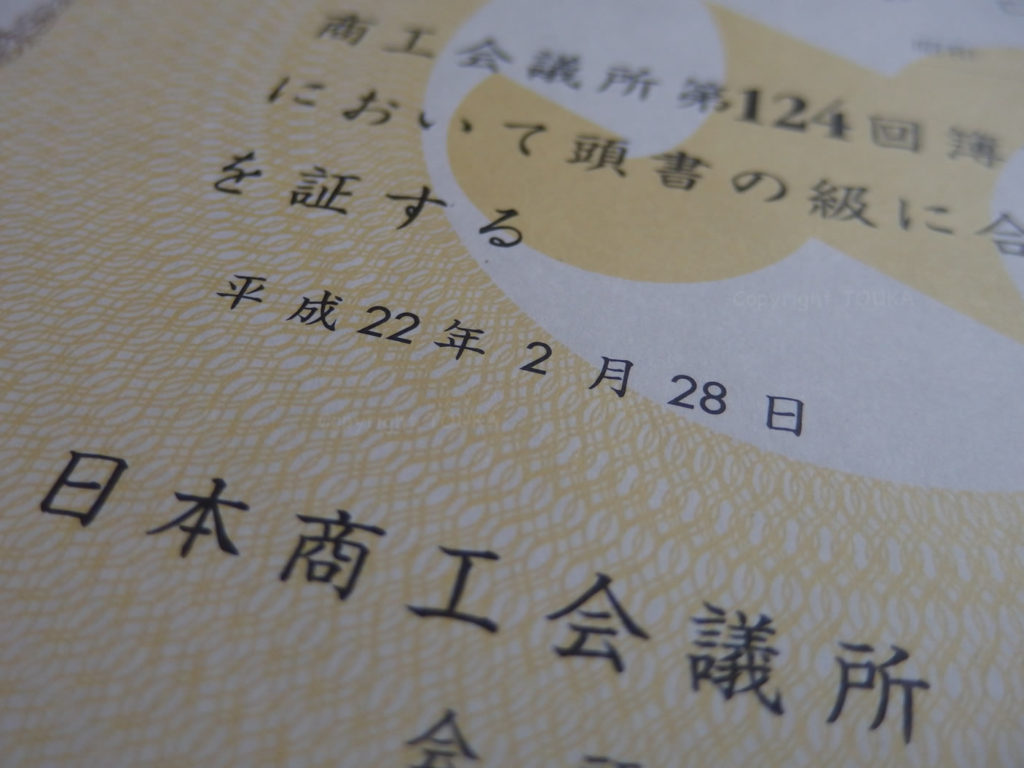

It was “The Official Business Skills Test in Bookkeeping, 3rd grade”.

There was a reason why I could get it. During the business stagnation, the company I had worked for was struggling to obtain government subvention. They prepared various activities, such as furlough and employee training. One of them was the training of “Bookkeeping, 3rd grade” specially for managers, which was assigned by the president of that time. He has a clear objective for that training. He wanted all manager of the company to have financial skill to manage such as a little RAMEN shop in town. It was really wonderful slogan he told to us.

Now, as a business owner of a little guesthouse, not a RAMEN shop, I feel the skill very helpful which I got at the first examination after the training. In the bookkeeping world, “double‐entry bookkeeping” is the normal method/theory, but it is a little difficult for ordinary people who are accustomed with math. We could know how difficult to adopt ourselves to the “double‐entry bookkeeping”, when we see many smart engineer type managers could not pass the exam. It was really lucky for me to attend to the training for the skill with quality teachers whose fee was payed by the company.

The skill to make statement of accounts helps me very much now. In the actual business world, officers in tax office are not so mean and helps us to file a tax return very kindly. As long as we visit them with our statement of accounts, they instruct us attentively. If we think carefully, we can find that it is natural that they will get their pay from the tax filed by us. (This may happen only in local tax office. But I heard that there is some bold people who tried to make their financial statements at tax office with getting officer’s aid.)

This introduction has become quite long, but what I wanted to tell is that I want our young Japanese guests who read this to challenge to get the skill. Because I know that the skill/knowledge is very helpful, no matter he will still belong to the company or she will start up own business independently. As we can predict that we will have more free time by remote working now and furlough in next business stagnation coming soon. I hope you will remember this advice when you will wonder how to utilize free time in future.

Thank you and you have a nice day with good cost performance in long time range.

from Yassan,

Manager of a Little Guesthouse under a Little Lighthouse TOUKA

( http://touka-kanmon.com )

先のショックで得たもの

世界中に朝が、そして関門にもあさが来ました。

おはようございます。

ニュースを見ていると、ある単語が繰り返し叫ばれています。どうも経済界や株投資をする人たちの間では今の「非常事態」を「コロナショック」と呼んでいるようです。

そんなニュースの中で「先のリーマンショックでとられた対応を参考にする」という発言があったので、自分はどうしてたんだろうと振り返ってみました。思い出したのは先のショック後の経済低迷期に自分が得たものです。正確にいうと得たのではなく、取らされたのですが、、、

簿記3級です。

どうして取らされたかというと、事業低迷期に政府の助成金目的に当時勤めていた会社では一時帰休など色々な施策が展開されました。そうした施策の中に当時の社長キモ入りのひとつがあって、それが管理職に課した「簿記3級取得研修」です。その研修には社長自らの大義があって「経営者たるもの、町のちいさいラーメン屋程度の金勘定は理解すべきだ」という大変素晴らしい(今思えば)スローガンです。

本業が暇すぎることもあって、晴れて一発合格した検定ですが、「ちいさいラーメン屋」あらため「ちいさい宿屋」の店主になってみて、そのありがたさを実感しています。簿記の世界では複式簿記というのが算数・数学とは少し異なるちょっととっつきにくい理論です。当時、院卒バリバリ理系の管理職は受からなかったことからも算式としての視点の違いが分かります。そんな資格とるための研修を会社持ちで、最高の講師のレッスンを受けることが出来てラッキーでした。

おかげでなんとか決算書は作成できるレベルになり、今とっても役に立っています。実社会では、税務署は思ったより意地悪でなく、決算書さえ持参すれば確定申告書への記載・入力は手とり足とり教えてくれます。よく考えてみると、その結果納められる税金で彼らは食っているわけなので優しくて当たり前です。(ただこれは地方だけかもしれません。なかには確定申告の会場で決算書作りの指導を受けるツワモノもいるそうです。)

というわけで、長くなりましたが、、、何が言いたかったかというと、これを見ていただいている日本の若いゲストさん達には、是非「簿記3級」にチャレンジしてもらいたいということです。たとえそのまま企業内にいても、ましてや万が一にも起業・独立したいなんて考える時には、その資格=知識が大きな助けとなることは間違いありません。感染対策の在宅勤務やこれから訪れる経済低迷期の一時帰休などで思いがけなく時間が出来る時に、ご自身の有益な時間の使い方として思い出してもらえれば幸いです。

それでは、長い目でコスパの良い素敵な一日を!

灯台下のちいさいゲストハウス「灯火」宿主 やっさん より

( http://touka-kanmon.com )